One of the recurring things we have picked up when talking to other people is their obsession with trying to get a 5-10% increment on their base salaries from their employers. Then the topic transitions to getting a bigger bonus – “my boss told me that the bonus this year will be greater than last year’s.” If either fails, they then focus on searching for new jobs externally in the hope of getting a 15-20% jump. Almost never do they consider trying to generate this same percentage increase by themselves through building some sort of small business.

We used to constantly speculate on why this was the case considering none of these people were happy in their jobs and always dreaded Monday mornings. A more in-depth chat with any of these knuckleheads also teaches you that they aren’t happy about their lack of freedom (i.e. having only 20 days AL per year to travel and pursue their real passions). This was confusing to us for some time but we believe that we now have the answer: The average person is terrified of being completely dependent on themselves and are afraid to start anything in the first place. When you are an employee in the workforce, you have a line manager you report to who acts as your daddy/mommy and tells you what to do. Prior to this, you were in college/high school where you also had authoritative figures providing you with a clear set of guidelines of what to do to be considered successful. Consequently, your brain has become wired over the course of 2+ decades to take orders with limited opportunities to start completely from scratch at your own pace and discretion. The only problem? In business, there is no set of rigid guidelines that determine financial success. Why? Because if it were so clear, literally everyone would be multi-millionaires and the standards for defining rich would be 1000x higher than what they are now.

With so many people these days terrified of and averse to even the most negligible levels of risk, we will run through the basic math in this post to prove why it makes a ton of sense to generate your own side-income.

Employment Income vs. Business Income

Let’s say you are already doing pretty well for yourself and currently bringing in a quarter million dollars gross. To make this type of money as a salaried employee in the United States, you are most likely living in a state with a high income tax. For simplicity, let’s put this figure at 35%- You are pocketing $163K per year after taxes.

Let’s say you spend a substantial amount of time trying to get a 10% salary adjustment on the job market – that becomes $25K gross which becomes about $16K after taxes (possibly more as it could elevate you into the next tax bracket). In the grand scheme of things this really isn’t that much money. You’re barely making $1.3K more in additional income on a monthly basis.

What about if you venture into a brand-new business on the side and make the same amount in additional income through this business ($25K)? For starters, you can now deduct business expenses since it is highly improbable you have a 100% operating margin. Having a 50% operating margin is perfectly okay and won’t raise any alarm bells. So if you post $25K in income, deduct $12.5K (essentially for item purchases you would make either way) then you are now only paying less than half the amount in taxes on the additional income ($4.4K vs. $9K). This means your net income is $20.6K (vs. $16K above).

Sure, some of you might say that this difference is negligible. This is true, but it is still a 29% increase compared to your other alternative (finding a new job). That’s a huge difference over the span of a decade. Were you to add $100K in business income over $100K in income from your career the difference becomes far more significant. Additionally, your risk drops substantially with the second set up. Would you prefer to have your financial circumstances bound to a single income stream of $350K or two income streams of $250K and $100K. The choices are not even close.

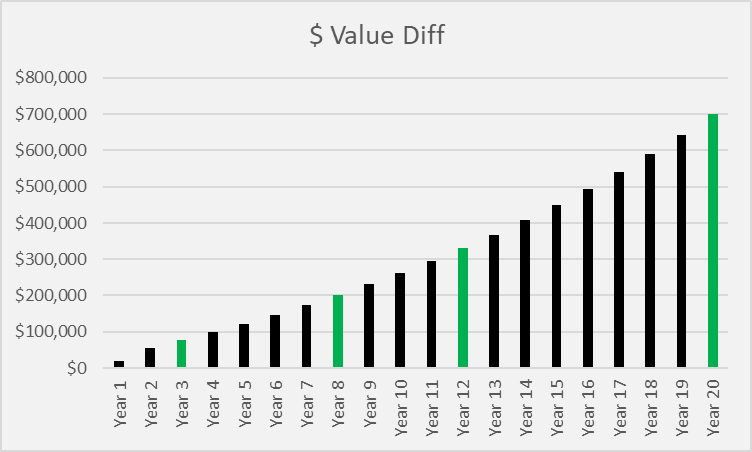

Let’s look at an additional case involving two people: Individual 1 brings home $100K from his business while Individual 2 earns $100K from his job as a W-2 employee. The difference here would be $17.5K after taxes (understated as it is likely higher for the career person). Assuming a standard 6% compound interest rate, the difference in a decade’s time would be in excess of $250K. This is a huge sum of money for the overwhelming majority and is enough to buy a decent-sized apartment in many parts of the developed world. Not to mention that this is also after tax gains, meaning that you can have no more than a 15% tax-rate at the conclusion through long-term capital gains.

To visualize this graphically, within three years the difference becomes the value of a luxury sedan straight off the lot, within eight years this becomes exactly $200K, by year 12 you have enough to buy a decent apartment in most major cities within the United States, and by year 20 this becomes two properties or a single house in an affluent neighborhood.

Before we end this section, we want to address a rebuttal that we know will come up. Some of you might point out that there are plenty of regional financial centers outside of the United States that offer high pay coupled with extremely low income taxes (Singapore, Dubai, Hong Kong, etc.). First of all, if you are American this doesn’t really matter because the IRS will be harassing you regardless of where you live in the world. Additionally, these same jurisdictions have low income taxes because they are business-friendly, meaning that they will usually have even more favorable tax regulations towards businesses and corporations. As an example, the maximum income tax bracket in Hong Kong is 17%, but there is no dividend tax. This means if you happen to work there and register your business as an LLC you will be effectively paying 0% tax on your business income.

How To Get Started

We are going to speak to the lowest common denominator here and assume that you are an extremely lazy individual who struggles to even get out of bed and try something new. If you are one of these loafers, we have good news for you: You can take immediate action as soon as you have finished reading this post. Since coming up with a product will probably seem like too much work and risk for you right now, let’s go with providing a service, something you can do right off the bat. Here are the actionable steps:

- Step 1: Look up all the universities within a twenty-mile radius of your residential address and pick the two with the largest on-campus/commuter student populations.

- Step 2: Print out and stick posters advertising your service offering.

- Step 3: Wait patiently.

Straightforward right? Well, most people who claim to really need/want extra cash are too lazy to even do this. Believe it or not, everyone has at least one skill they are good at, even that drug-addicted bum on the street, so if you are earning over 100K/year in your career, plenty of people would be willing to pay you for your advice, input and time. If you live on a ranch out in the middle-of-nowhere Montana simply replace university with “any place with the largest potential population of your target market” and extend the radius to one hundred miles.

If you are really absolutely convinced that you have no marketable skill set, drive to Walmart, buy a few dozen six-packs of Bud (or Modelo which seems to be the trend these days) and resell them for a premium near stadiums on game days. You’d be surprised how lazy ordinary people are – there will be plenty of people who are craving beers but couldn’t be bothered to stop by Costco/Walmart on the way.

So to summarize, all you need to do here to get started is to ask yourself the following two questions: 1) What am I good at?, and 2) What is a high-demand service/product I can sell and where is the nearest geographic location to target that demand? At the very least, you should be able to answer that first question. If you can’t then you should ask yourself a more serious question: How the hell am I employed in the first place? If you can’t answer this question either then you should be worried as you are in deep trouble and will be one of the first to be laid off.

As for Question (2), if you genuinely don’t know the answer and don’t have the reliable tools to conduct quick research and find out, you can always sell your service/product online.

Baby Steps

Let’s say you aren’t particularly excited about your financial performance in the first 12 months and only make about $10K-20K. This isn’t a bad result because the initial learning curve is steep and chances are you have already made a ton of mistakes and learned from them. Instead of binging Netflix or pounding beers you spent your weekends on a scalable side-hustle and learned the following in the process: 1) Optimal pricing, 2) Effective marketing, 3) Web design, 4) Web traffic/SEO, and 5) How to scale.

These are all skills you can immediately transfer to the next business venture you engage in, irrespective of what the product/service offering is. You are now set for life because you have the tools necessary to create income irrespective of what kind of downturns take place in your career or in the macroeconomic environment. Also, the fact that you are now partially relying on yourself as opposed to wholly relying on the discretion and decision-making of an employer should be extremely reassuring and a sign that there is nothing stopping you from wholly relying on yourself, thereby keeping more of the revenue you generate and setting your own schedule as you please. The longer you stay an employee, even if you are consistently receiving pay increases, the worse it gets. You end up losing more and more of your freedom and find yourself on call more. By the time you realize just how deep of a hole you are in… you are already too far below ground level to climb back out.

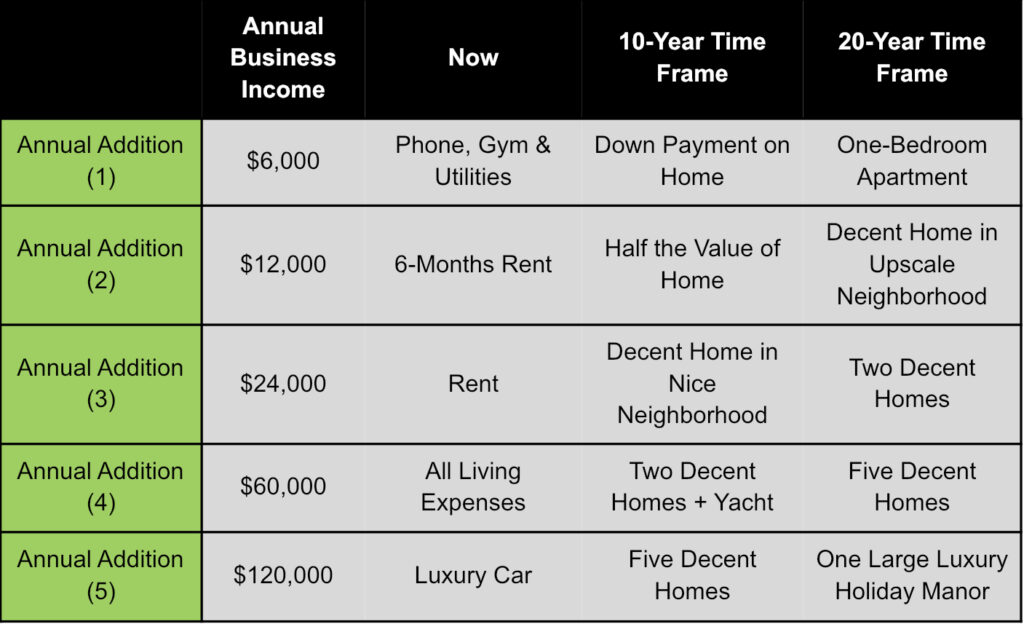

As an example of how your side-hustle income can scale, we have generated an annual addition table at the following numbers: 1) $500/month, 2) $1K/month, 3) $2K/month, 4) $5K/month, 5) $10K/month.

This table gives you an idea of the power of compounding in material terms. If you are making a quarter million dollars per year, adding $1K per month through income from your side business may seem pretty insignificant, but a decade from now you’d be able to purchase a home in cash (standard income + side-hustle earnings). That’s a big deal especially if you are currently in your early twenties. Imagine reaching your early thirties and seeing your cost of living decline even amidst higher levels of inflation because you made a single intelligent decision a decade prior. More likely than not, if you are able to generate $1K/month after one year this figure will grow by at least several multiples and you’ll have multiple properties within a 15-20 year time frame.

Concluding Remarks: So there you have it. In this short post we have not only proven to you the immense virtues that come with building an additional revenue stream but also provided an easy guide on how to take action. No matter how much money you are making as an employee, you will never be happy or free because this source of income stops trickling in the moment you stop working. Not to mention you will constantly be worried about getting laid off if you have a high base salary as all companies will do cost-cutting from time to time to make their operations more lean. Having a side-business not only helps you diversify with an additional revenue stream but also gives you a vehicle that earns money even as you sleep. So if you still aren’t convinced, just ask yourself the following question:

“Would I rather work 30% harder for the next 5-10 years or work at my current pace for the next 40?”

It’s your call.